What Are Effective Ways to Discuss Competitive Threats with Investors?

Confronting Competitive Threats Head-On: A Guide for Startups Seeking Investment

Confronting competitive threats head-on can be a daunting task for startups seeking investment. As a founder, it’s your responsibility not just to identify these threats but articulating them in a way that reassures investors about the robustness of your approach. Here’s how you can communicate about competitive threats with investors and turn potential risks into convincing narrative arcs for your business strategy.

Understanding the Competitive Landscape

Your first port of call is to conduct a thorough analysis of your competitors. Who are they? What have they achieved? Where do they outperform you, and where do you have the edge? By delving into the competitive fabric of your industry, you get a clear picture of the stratagems you’re up against. This knowledge base will prove indispensable as it underpins the entire discussion about competitive threats.

Gathering Data and Evidence

When you dive into communicating competitive threats with investors, arm yourself with data. Whether it’s market research, customer surveys, or analytical reports, concrete evidence lends credibility to your assertions. Sharing data that illustrates the hurdles you’re facing sends a message: you’re not just aware of these threats; you’ve measured them.

Identifying Specific Threats

With your data in hand, pinpoint and prioritize the specific threats to your business. Maybe it’s a groundbreaking product from a rival, a shift in consumer behavior, or even disruptive technology that’s changing the playing field rules. By naming these threats explicitly, you concretize investor discussions.

Providing Context and Analysis

Laying out the facts isn’t enough. Investors need a narrative – context and analysis that weave data points into a story about your market. How might these competitive threats affect performance metrics like market share or revenue? What’s the broader implication for growth and sustainability? Your analysis should bridge the gap between isolated information and the overarching impact on your business.

Highlight Your Competitive Advantages

It’s crucial to communicate not just where threats are coming from, but also how your startup is uniquely positioned to handle them. Do you have proprietary technology, an enviable brand, or a rock-solid customer base that others can’t easily replicate? Position your advantages front and center as you manage competitive threats with investors.

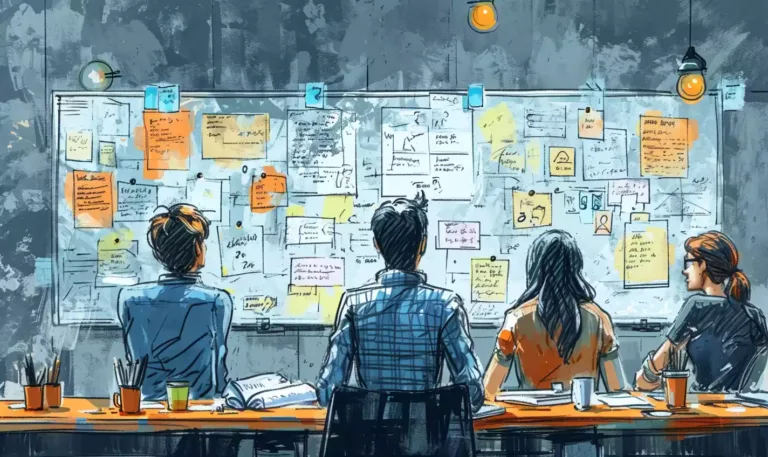

Developing a Mitigation Strategy

Having a game plan ready to confront competitive threats is non-negotiable. Investors will want to hear about concrete strategies like innovation accelerators, differentiation tactics, cost leadership models, and potential strategic partnerships. It’s not just about having these strategies, but also articulating them in a concise, compelling manner.

Addressing Investor Concerns

Remember, investor presentations on competitive threats aren’t monologues; they invite questions and concerns. Preempt these with thorough preparation, and stay agile in your responses. Illustrate with examples and scenarios how you intend to navigate these competitive shoals.

Communicate with Transparency

Integrity in communication often separates good investment opportunities from great ones. An open dialog about risks and management strategies can bolster an investor’s confidence in your startup’s leadership acumen.

Implementing these strategies for addressing competitive threats with investors sets the stage for dialogues punctuated by transparency, reinforced by data, and underscored by strategic insight. It’s not about eliminating uncertainty—it’s about demonstrating your mastery over it.

Key Takeaways:

- Know your competition inside out. A granular understanding of the competitive landscape is critical.

- Evidence is king. Back your talking points with robust data and clear evidence.

- Be specific. Vague references to competition won’t cut it. Clearly state what the threats are.

- Contextualize threats. Help investors see the bigger picture and how threats could potentially affect your business.

- Shine a light on your unique values. What makes your startup a winner despite the threats?

- Have a counter-strategy. Reveal your plans to mitigate competitive threats credibly.

- Engage in active dialogue. Addressing concerns directly can assuage investor fears.

- Opt for openness. Honesty in discussing threats is often a strength, not a weakness.

Questions to Ask Yourself:

- Can I delineate the competitive landscape in detail?

- Have I acquired sufficient data to back up my assertions about threats?

- Are my strategies to mitigate these threats both sound and clearly communicated?

- How do I anticipate and respond to investor concerns regarding competition?

- Do I consistently practice transparency in investor communications?

If you’ve found this post helpful, you might be just the discerning reader who would benefit from “Impress Every Investor.” This resource is a treasure trove of insight for startups eager to make a splash with their pitches. For tailored advice and pitch coaching that can take your investor conversations to the next level, don’t hesitate to reach out to us directly. With a helping hand, your startup can navigate competitive threats with finesse and emerge victorious in the eyes of those who hold the purse strings.