Leveraging Historical Financial Data in Equity Financing Projections

Understandably, the journey to secure equity financing is a challenging one, with many startups vying for attention and funding. As a founder, your ability to develop a compelling case for investment relies on not only presenting a visionary future but also demonstrating a thorough understanding of your company’s financial past. This is where leveraging historical financial data becomes critical in developing realistic and persuasive equity financing projections.

Gathering and Analyzing Your Financial Footprint

Before you can forecast tomorrow’s success, you must first make sense of yesterday’s numbers. Historical financial data—the income statements, balance sheets, and cash flow statements—serve as the narrative of your business’s financial journey. Collect this data from company’s annual reports, previous SEC filings, or verified financial databases. But raw data alone tells only half the story.

The next step is historical financial analysis, where the focus is on how well the company has managed revenues, costs, liquidity, and financial stability. By computing key financial ratios like gross margin and return on equity, you can assess financial health and prepare to answer tough investor questions with confidence.

Digging deeper, identify financial data trends to understand your business’s trajectory. Pinpoint growth influences or financial potholes—industry dips, market spikes, key operational changes—and remember, no detail is too small when your future financing lies in the balance.

Excluding the Outliers

When your goal is to project equity financing, precision is key. Non-recurring items, those one-time events like asset sales or legal settlements, can skew projections if not dealt with appropriately. These must be identified and excluded to ensure your future predictions aren’t marred by historical anomalies.

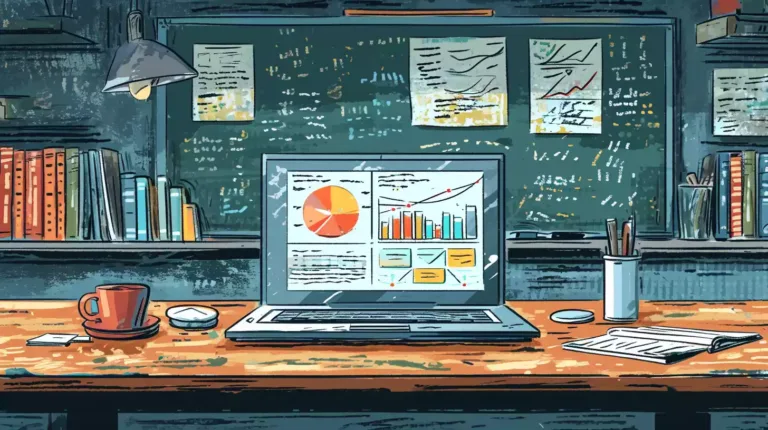

Projecting the Future Through the Lens of the Past

Now comes the construct of your financial forecast. Integrating your carefully curated historical data within a financial model, you’ll need to paint a picture of what lies ahead. But it’s not enough to present numbers; you must weave a narrative linking market conditions, growth rates, and strategies that are grounded in reality and yet reach for the ambitious.

During this process, consider various factors to enrich your projections. How will market changes or competitive dynamics affect your business? Remember to factor in revenue growth, cost control measures, capital expenditure plans—and don’t forget the subtle nuances of working capital requirements.

Navigating the What-ifs with Sensitivity Analysis

The financial landscape is riddled with uncertainties, and investors are keenly aware of this. They seek founders who not only recognize potential risks but also prepare for them. This is where performing a sensitivity analysis is instrumental, giving insight into how your projections hold up under various financial stress-tests. Change your input values—growth rates, costs, interest rates—examine the outcomes, and brace your projections for real-world volatility.

Validation: The Reality Check

With future projections in hand, it’s crucial not to operate in a vacuum. Validation against industry benchmarks, analyst estimates, and market trends helps ensure that your projections are not only grounded but also competitive. Adjust your forecasts as necessary, maintaining a diligent eye on business and market flux.

Articulating Your Vision

Finally, the way you communicate your findings—the story you tell—is as critical as the numbers themselves. Present your equity financing projections explicitly, supporting them with historical financial data and sound analysis. Clearly delineate the assumptions and risks to demonstrate to investors that you are thorough and transparent.

Key Takeaways:

- Historical financial data is the backbone of credible financial projections.

- Remove non-recurring items to avoid distorting future predictions.

- Use validated financial models to depict a realistic, yet ambitious future.

- Sensitivity analysis is crucial for understanding and preparing for financial uncertainties.

- Validating projections against industry benchmarks is key to maintaining realism.

Questions to Ask Yourself:

- Have I collected and reviewed all necessary financial data for analysis?

- Did I identify and account for all non-recurring items in the historical data?

- Have I included all relevant market conditions and industry trends in my projections?

- What are the weakest points in my financial forecast, and how have I addressed those risks?

- How can I present this data in a way that is both compelling and understandable to investors?

For startup founders who find themselves at the crossroads of financial projection and seeking investment, remember: a strong foundation in historical financial data analysis serves as the stepping stone to a more convincing and successful pitch for equity financing. If you feel you need more guidance on this journey, consider investing in your financial acumen by reading “Impress Every Investor”. For personalized support, reach out to us and let’s refine your pitch to resonate with your investors.