How Can Startups Raise Funds from Venture Capitalists?

Raising Funds: A Guide for Startups

Raising funds is a crucial step for startups looking to scale their operations and make a big splash in their respective industries. Venturing into the world of venture capitalists (VCs) can be a game-changer, and in this post, we’ll unpack the strategies to help your startup navigate the funding landscape successfully.

Developing a Robust Business Plan

This isn’t just a document—it’s a roadmap for your startup’s future and a testament to your vision. It should give a clear view of your market opportunity, strategic positioning, and detailed financial projections. Remember, VCs are inundated with pitches; your business plan is what can make or break their initial interest.

Targeting the Right VCs

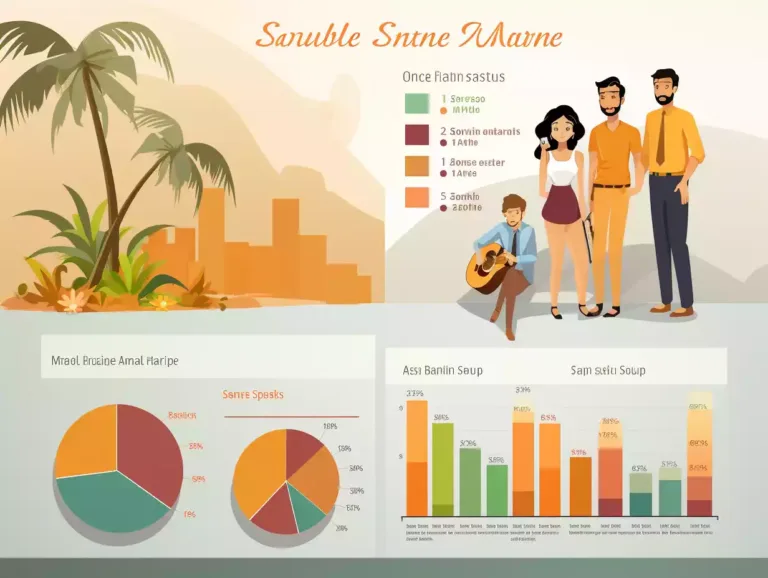

Now, it’s not about spraying and praying. You want to target the right VCs who have a penchant for your industry and can add value beyond funding. Conducting research to align with venture capitalists who have historically backed similar startups can save you time and increase your chances of securing that coveted investment.

Building Relationships

Networking might seem tiresome, but it’s where the seeds of fruitful investor relations are planted. Make your presence felt at industry events and engage with the ecosystem—you’ll be surprised at how a casual conversation can lead to a solid intro.

Crafting Your Pitch Deck

As you gear up for your pitch, remember that your pitch deck is a reflection of your company’s essence. It goes beyond the numbers and into the narrative, establishing not just the potential for profit, but the passion behind the project. It should succinctly express your startup’s unique value proposition, market potential, and the progress you’ve made so far.

Presenting to VCs

When the moment comes to present to VCs, clarity, confidence, and candor are key. It’s about striking a balance: you’re not just recounting numbers and projections, you’re weaving a story that invites the investor to be a part of your journey. Your ability to respond to queries thoughtfully can greatly increase your chances of making an impact.

Preparing for Due Diligence

Don’t be caught off-guard when due diligence begins—venture capitalists will dissect your startup’s prospects. It’s not just about verification; it’s an opportunity to demonstrate your startup’s thoroughness and transparency.

Negotiating the Term Sheet

The term sheet is another crucible moment. It defines the investment terms and conditions, so negotiate wisely. The ownership stakes, valuation, board representation—all these elements need to align with your long-term goals and vision for the startup. A term sheet isn’t just paper; it becomes the foundation for your partnership with the VC.

Navigating Legal Documentation

As you navigate legal documentation, prudence calls for expert help. Ensuring your legal bases are covered not only protects your startup’s interests but also demonstrates your professionalism to the VCs.

Sealing the Deal

Sealing the deal is a cause for celebration—but the work doesn’t stop at the handshake. The real journey begins with maintaining and nurturing the investor relationship through transparent updates and honest communication. A venture capitalist is more than a wallet; they’re partners, advisors, and occasionally, crisis managers.

Remember, there’s no one-size-fits-all strategy. It’s about understanding your startup’s unique needs, aligning those with the right venture capitalists, and crafting a narrative that resonates.

Key Takeaways

- Start with a polished, comprehensive business plan.

- Research and identify VCs that resonate with your startup’s mission.

- Network to build relationships and secure introductions.

- Develop a compelling, succinct pitch deck.

- Approach pitch meetings with clarity and readiness to address concerns.

- Prepare for a thorough due diligence process.

- Approach term sheet negotiations with a clear understanding of your startup’s goals.

- Get legal counsel for documentation to protect your interests.

- Maintain strong, transparent relationships with venture capitalists post-investment.

Questions to Ask Yourself

- Does my business plan accurately reflect my startup’s potential and roadmap?

- Have I researched venture capitalists that align with my startup’s values and needs?

- Is my pitch deck tailored to address the concerns and interests of VCs?

- Am I prepared to provide thorough answers and documentation during the due diligence process?

- How can I ensure the terms on the term sheet align with my startup’s long-term vision?

- What strategies do I have in place to mitigate risks and build confidence among potential investors?

Whether you’re preparing for your first fundraising round or looking to refine your current strategies, securing capital is a pivotal step. If reading this ignites a spark realizing you might need a guide to leave a lasting impression, consider purchasing the book “Impress Every Investor”, a perfect compendium for those eager to ace the art of fundraising.

Perhaps you’re looking for personalized guidance? In that case, don’t hesitate to tap into expert advice by hiring us as your pitch coach. Navigate to Funding PitchCraft to embark on a tailored journey to funding success. With the right plan, pitch, and people, your startup can achieve funding feats and march confidently into growth and innovation.

One Comment