What Strategies Can Startups Use to Build Investor Confidence?

Building investor confidence is not just about having a disruptive idea—it’s also about signaling trust, demonstrating potential, and showcasing sustainability to those who might fund your dream. You are not just building a product; you are building a case for investment. In this blog post, we unpack actionable strategies that can help startups enhance investor confidence. By bridging ambition with evidence, startup founders can navigate the fund-raising process more effectively and forge stronger relationships with potential investors.

1. Craft a Compelling Value Proposition

For startups, a clear value proposition is like a North Star—guiding and compelling. It’s essential to articulate what problem your product or service is solving and how it stands out from the competition. Investors are on the lookout for startups that address genuine pain points with innovative solutions, so make sure your value proposition resonates loudly and clearly.

2. Conduct In-Depth Market Research

Market opportunity is your canvas, and investors want to know its size, growth potential, and competitive dynamics. Delving into market research provides startups with crucial insights to back their claim of a promising opportunity. Use data effectively to paint a picture of a market ripe for your product or service, and ensure that investors see not just the potential but the evidence supporting it.

3. Showcase a Strong, Capable Team

Startups don’t just run on ideas—they’re powered by people. Investors invest in teams as much as in ideas, and a startup with a skilled, experienced team instills confidence. Highlight your team’s expertise, their past achievements, and their dedication to turn the startup’s vision into reality. A team that can execute is a team worth betting on.

4. Present a Clear Business Model

A well-defined business model is crucial for startups to showcase how they’ll generate revenue and ultimately achieve profitability. A sound business model outlines a clear path to financial success and is a critical component in boosting investor confidence. Your business model should articulate the value chain, pricing strategy, and revenue streams, demonstrating an in-depth understanding of how the startup will operate in the market.

5. Develop a Solid Financial Plan

Investors seek assurance that a startup is financially astute. Building a detailed financial plan, complete with revenue projections, cost breakdowns, and key metrics, proves that you take the financial aspect of your business seriously. Show investors that you are prepared for various scenarios and that your financial strategy is geared for growth.

6. Demonstrate Traction and Achievements

Nothing speaks louder than real results. If your startup has hit significant milestones, acquired customers, or forged key partnerships, highlight these wins. These accomplishments are testament to your startup’s momentum and ability to execute—a clear indicator to inspire investor confidence.

7. Network and Establish Credibility

The saying “It’s not what you know, but who you know” rings particularly true in the startup ecosystem. A solid network can provide introductions, knowledge, and even lend credibility to your startup. Attend industry events, engage with startup communities, and find mentors who can help open doors to potential investors.

8. Secure Endorsements and Testimonials

A vote of confidence from a respected industry figure, a satisfied customer, or a loyal partner can make a world of difference. Endorsements and testimonials can bolster your startup’s legitimacy and appeal in the eyes of investors. These third-party validations can be powerful in enhancing investor confidence.

9. Maintain Transparency and Proactivity

Investors value openness and honest communication. Regularly update your investors about progress, tackle challenges head-on, and be upfront about risks and concerns. Transparency not only builds trust but also highlights your integrity and dedication to mitigating risks—attributes that investors greatly admire.

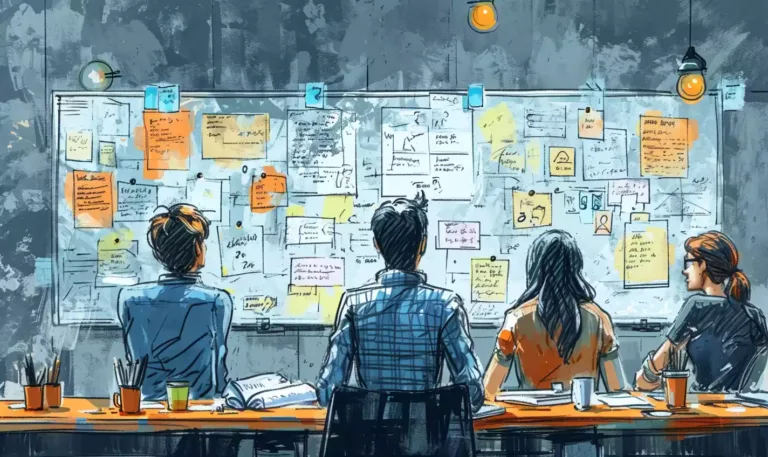

10. Embrace Feedback and Iterate

Successful startups are those that adapt and evolve based on feedback from a wider ecosystem. Show investors that you are open to advice and committed to refining your startup’s approach. Engaging with feedback and tweaking your strategy accordingly is a strong indicator of a responsive and dynamic leadership team.

Key Takeaways:

- Developing a compelling value proposition is foundational in building investor confidence.

- Demonstrating a deep understanding of the market opportunity is crucial.

- An experienced, cohesive team can be as appealing as the idea itself.

- A clear business model and a thorough financial plan are non-negotiable for instilling confidence.

- Traction in the form of milestones and results can accelerate investor interest.

- Building networks and securing testimonials add layers of credibility.

- Transparency in operations and flexibility to pivot as needed embody a startup ready for investment.

Questions to Ask Yourself:

- Have I communicated my startup’s value proposition with clarity and conviction?

- Does my market research reflect a substantial and sustainable opportunity?

- Are the strengths and track record of our team being showcased effectively?

- Is our business model clearly defined and easily understood by potential investors?

- Have we prepared a financial plan that is both realistic and indicative of significant growth potential?

- What milestones can I present to demonstrate traction and progress?

- How can I bolster my network to enhance my startup’s credibility amongst investors?

- What endorsements or testimonials could I pursue to bolster investor confidence?

- Am I maintaining transparent communication with potential and current investors?

- How am I responding to feedback, and am I prepared to iterate our strategy to fit market needs?

With the strategies outlined in this guide, you’re now equipped to build a powerful case for your startup that resonates with investors.

If you need further guidance on polishing your pitch to impress every investor, consider exploring www.impresseveryinvestor.com. You’ll find invaluable insights that can take your presentation to the next level. Alternatively, if you seek personalized support, visit www.fundingpitchcraft.com/contact-us to hire us as your pitch coach. Let’s transform your fundraising journey into a successful endeavor, together.